Why Are Car Insurance Rates Going Up?

Car insurance rates are more than 22% higher now than they were a year ago. That means if you were paying $150 a month, you’re now up to $183, and you’re not alone. In fact, most of us are paying so much more for car insurance that it’s currently one of the biggest drivers of inflation. “Even wage increases won’t prevent many people from feeling the squeeze on their budgets,” says Maya Afilalo, Senior Editor and Analyst for AutoInsurance.com. Here’s why rates have gone up so much, and some tips from our experts on how to lower your bill without jeopardizing your peace of mind. Why Are Car Insurance Rates Going Up? Insurance companies are paying out more in claims, which means they have to charge higher premiums to stay profitable. But it’s a bit more complex than that, and here’s why. Accidents Are On the Rise There are more accidents than there were a few years ago, and many are more severe, in part because we’re driving bigger vehicles, and road rage and reckless driving are on the rise. “Distracted driving has also driven accident rates to new highs,” says Ezra Peterson, Senior Director of Insurance at Way.com. “More accidents, plus more expensive accidents, means higher premiums.” Severe Weather Events Are Growing Due to the climate crises, the frequency of catastrophic weather events has increased, leading to more vehicle damage from floods, hail, fire and other natural disasters, says Afilalo. Parts and Repair Labor Have Spiked The price of repairs, auto parts and new and used vehicles have all risen during the last few years. Some of this was due to pandemic-related supply chain issues, plus a vehicle shortage. “While supply chain issues have mostly receded, the increased cost of parts and labor translates directly into higher repair costs,” says Peterson. Car Technology Has Advanced Today’s cars have more tech, like integrated safety devices, parking sensors and crumple zones. What was once a fender bender fixable with a little body work can now cost thousands of dollars in electronics and specialized labor to repair, says Peterson. This has caused the average payout to rise 82% over the past decade. Advertisement Medical Expenses Are Rising Rising healthcare costs means higher payouts. It’s also becoming more common for medical expenses to breach policy limits, which translates to higher administrative rates from lengthy court processes. Carrying Costs Are Expanding The time from the opening of the claim to its closing has stretched, partly due to staffing limitations on the claims side and labor shortages on the repair side, says Peterson. “Claim files are taking longer, which has its ancillary costs in rental and substitute auto coverages, storage fees, etc.” Factors That Impact Car Insurance Rates Some factors insurance companies take into account when determining your premium include: Driving Profile This includes your age, years of driving experience, driving violations, previous insurance claims and, often, credit score. Factors like being a teenager or having a DUI significantly increase rates. Location Drivers in urban areas often have higher premiums due to higher accident and theft rates. Areas prone to severe weather and uninsured drivers also have elevated rates, says Afilalo. Coverage Choices Lower deductibles and higher coverage limits mean higher rates, but they also mean more financial protection if you do have an accident. “Balancing these choices depends on your financial situation and how much risk you’re willing to assume,” says Afilalo. Vehicle Choices Your choice of vehicle directly affects your premium, though the old wive’s tale that red cars cost more is a fallacy, says Peterson. What does matter is the cost of repair, along with accident statistics. “A vehicle with specialized systems, rare trim packages, high theft rates, and electric vehicles will likely be more to insure than a typical sedan, all due to loss probability and cost to repair,” he says. Advertisement Tips to Lower My Car Insurance Rate Shop around for new providers. Increase your deductible. Opt into a usage-based insurance program or telematics discount. Bundle home and auto policies with the same provider. Drop non-required coverages. Lower liability limits. FAQ What is an average car insurance rate? Car insurance premiums vary widely because there are so many factors, but the national average is currently hovering around $2,000 to $2,500 for full coverage. How can I compare car insurance rates? You can get quotes directly from insurance companies. Afilabo recommends getting at least three quotes, from both major national providers and smaller regional ones. Or, you can a work with an independent insurance agency, which will do the legwork of getting multiple quotes for you. Is car insurance legally required? Yes, liability auto insurance, which covers damages to other vehicles if you cause an accident, is mandatory in every state except for New Hampshire. Bodily injury liability, which pays for the injuries of others if you cause an accident, is also required in every state except for Florida and New Jersey. Beyond that, in most states coverage to repair your vehicle and medical expenses is not a legal requirement, but often a wise idea, say Afilalo and Peterson. About the Experts Maya Afilalo is Senior Editor and Analyst for AutoInsurance.com. She has more than 10 years of experience in research and communications, helping customers sort through auto insurance information. Ezra Peterson is Senior Director of Insurance at Way.com. He has more than 20 years of experience in the insurance industry. Sources AP News: “Surging auto insurance rates squeeze drivers, fuel inflation“ Originally Published: September 05, 2024

At Home October 2024

This Is the Sweet Spot Homebuyers Have Been Waiting For

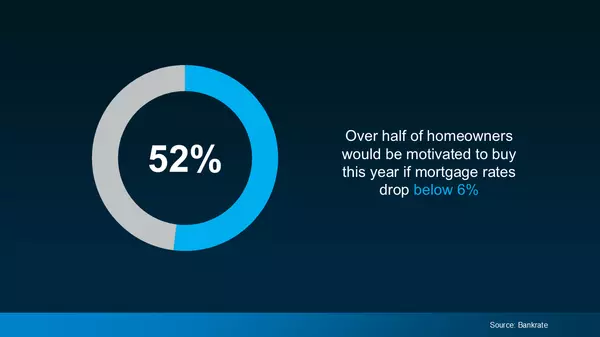

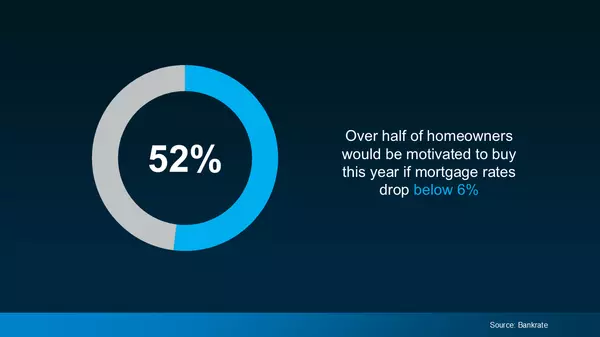

After months of sitting on the sidelines, many homebuyers who were priced out by high mortgage rates and affordability challenges finally have an opportunity to make their move. With rates trending down, today’s market is a sweet spot for buyers—and it’s one that may not last long. So, if you’ve put your own move on the back burner, here’s why maybe you shouldn’t delay your plans any longer. As you weigh your options and decide if you should buy now or wait, ask yourself this: What do you think everyone else is going to do? The truth is, if mortgage rates continue to ease, as experts project, more buyers will jump back into the market. A survey from Bankrate shows over half of homeowners would be motivated to buy this year if rates drop below 6%. With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you. That increased demand will likely push home prices up, which could potentially take away from some of the benefits you'd gain from a slightly lower interest rate. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), explains: “The downside of increased demand is that it puts upward pressure on home prices as multiple buyers compete for a limited number of homes. In markets with ongoing housing shortages, this price increase can offset some of the affordability gains from lower mortgage rates.” So, while waiting to buy may seem like a smart move, it could backfire if rising prices outpace your savings from slightly lower rates. What This Means for You Right now, you’ve got the chance to get ahead of all of that. Today’s market is a buyer sweet spot. Why? Because a lot of other buyers are waiting – which means not as many people are actively looking for homes. That means less competition for you. At the same time, affordability has already improved quite a bit. Recent easing in mortgage rates has made homeownership more accessible. As Mike Simonsen, Founder of Altos Research, says: “Mortgage payments on the typical-price home are 7% lower than last year and are 13% lower than the peak in May 2024.” And while the supply of homes for sale is still low, it's also higher than it’s been in years. According to Ralph McLaughlin, Senior Economist at Realtor.com: “The number of homes actively for sale continues to be elevated compared with last year, growing by 35.8%, a 10th straight month of growth, and now sits at the highest since May 2020.” This means you now have more options to choose from than you’ve had in quite a while. With fewer buyers in the market, improving affordability, and more homes to choose from, you have the chance to find the right one before the competition heats up. Why Waiting Could Cost You If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible. The longer you wait, the higher the risk that market conditions will shift—and not necessarily in your favor. As Greg McBride, Chief Financial Analyst at Bankrate, says: “It’s one of those things where you should be careful what you wish for. A further drop in mortgage rates could bring a surge of demand that makes it tougher to actually buy a house.” Bottom Line Don’t wait until you have to deal with more competition and higher prices – you already have the chance to buy a home while we’re in the sweet spot today. Let’s connect to make sure you’re taking advantage of it.LisaSwank,

Categories

Recent Posts